Saudi Arabia Social Insurance Law 2025: Key Reforms for Employers and HR

The Saudi social insurance law 2025 came into effect on July 1, 2025, introducing important changes to the Kingdom’s labor and social protection system.

The law applies to Saudi nationals entering the workforce for the first time and is designed to unify the pension system, improve long-term sustainability, and support the Kingdom’s Vision 2030 objectives.

Employers and HR professionals need to be aware of these changes to ensure compliance, adjust payroll processes, and guide employees effectively.

Who Is Covered

The new rules apply to Saudi nationals who begin employment on or after July 1, 2025, and who have not previously made contributions to social insurance.

Those who are already contributing will remain under the existing system, except in cases where transitional provisions apply, such as retirement age and eligibility.

Contribution Rate Changes

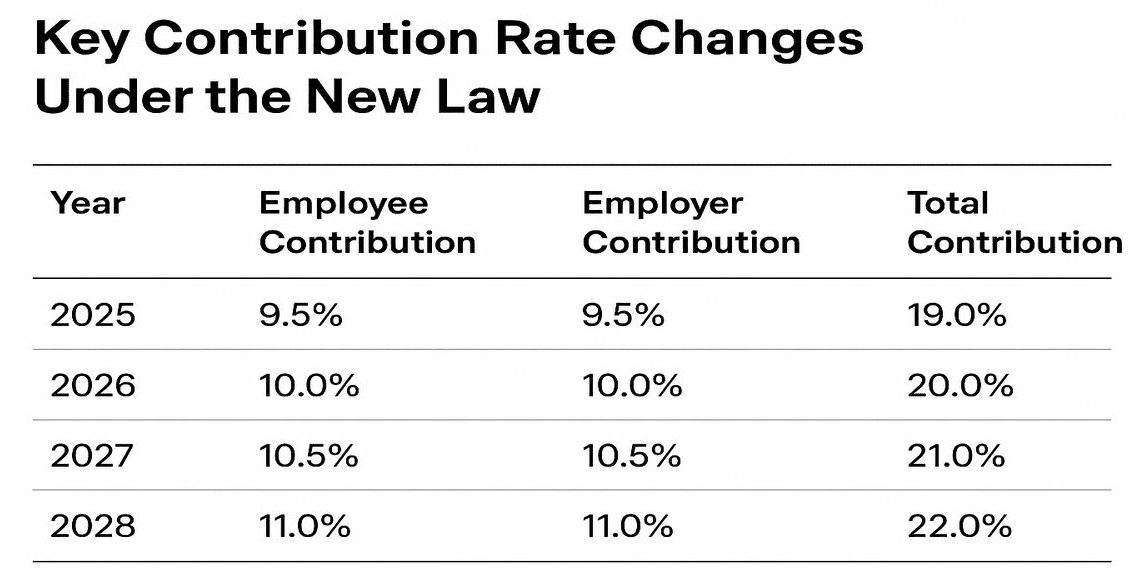

The law introduces a phased increase in contribution rates for both employees and employers over the next few years.

- 2025: Employee 9.5% | Employer 9.5% | Total 19%

- 2026: Employee 10% | Employer 10% | Total 20%

- 2027: Employee 10.5% | Employer 10.5% | Total 21%

- 2028: Employee 11% | Employer 11% | Total 22%

Contribution rate changes for employees and employers under Saudi Arabia’s 2025 social insurance law

Employers should make sure their payroll systems are updated each year to reflect these changes.

Main Provisions and Benefits

Unified Social Insurance Coverage

The law merges public and private sector pension schemes, making benefits more consistent and allowing employees to move between sectors without losing entitlements.

Retirement Age Adjustment

The standard retirement age will gradually increase to 65 years (Gregorian). Early retirement remains possible but depends on years of contribution and age when the law came into effect.

Pension Calculation

Pensions will now accrue at 2.25 percent for every year of contribution. The calculation is based on the average of the highest 180 months’ wages and is capped at 100 percent of the average salary.

Enhanced Maternity Benefits

Female employees are entitled to three months of fully paid maternity leave, funded by GOSI. An additional month may be granted in cases of medical complications, subject to contribution eligibility.

Compliance Steps for Employers

Employers should take the following steps to comply with the new regulations:

- Update payroll systems to apply the new contribution rates each year.

- Review and amend employment contracts and HR policies where necessary.

- Communicate changes in benefits and entitlements to employees.

- Ensure timely and accurate filings with GOSI to avoid penalties.

Why It Matters

The Saudi Arabia social insurance law 2025 is one of the most significant reforms in recent years. It strengthens social protection for employees, ensures pension sustainability, and creates consistency across sectors.

Employers who adapt quickly will not only meet compliance obligations but also maintain employee trust and avoid unnecessary risks.

Conclusion

The introduction of the Saudi social insurance law 2025 marks a key step in modernizing the Kingdom’s labor and social protection systems. For employers and HR professionals, the priority now is to align payroll, contracts, and compliance processes with the new requirements.

Taking a proactive approach will safeguard both business operations and employee wellbeing under the new framework.